BUSINESS CASE

Problem

With the acquisition of The Orchard by Sony Music, the company was tasked with having the ability to take in and distribute higher quality content. With iTunes leading the way in blocking low value content, there is now a higher bar for content at retailers. Spotify and others are quickly following suit. Content includes:

- Karaoke

- Tribute albums by unknown artists

- Redundant content that is already in the store (regardless of who delivered)

- etc

The Orchard has now changed the policy to no longer accept this content from clients given it now has very little value.

Opportunity

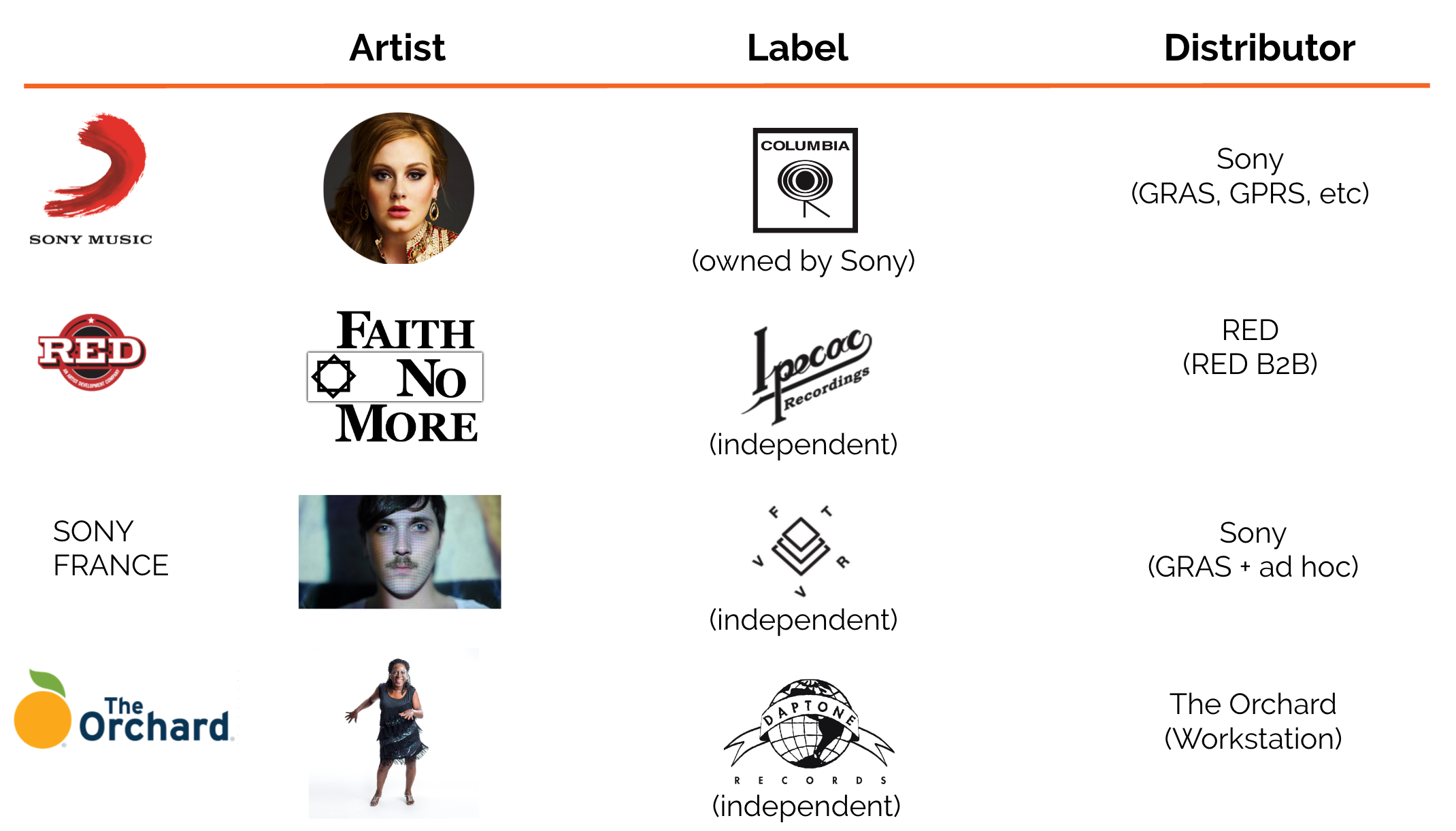

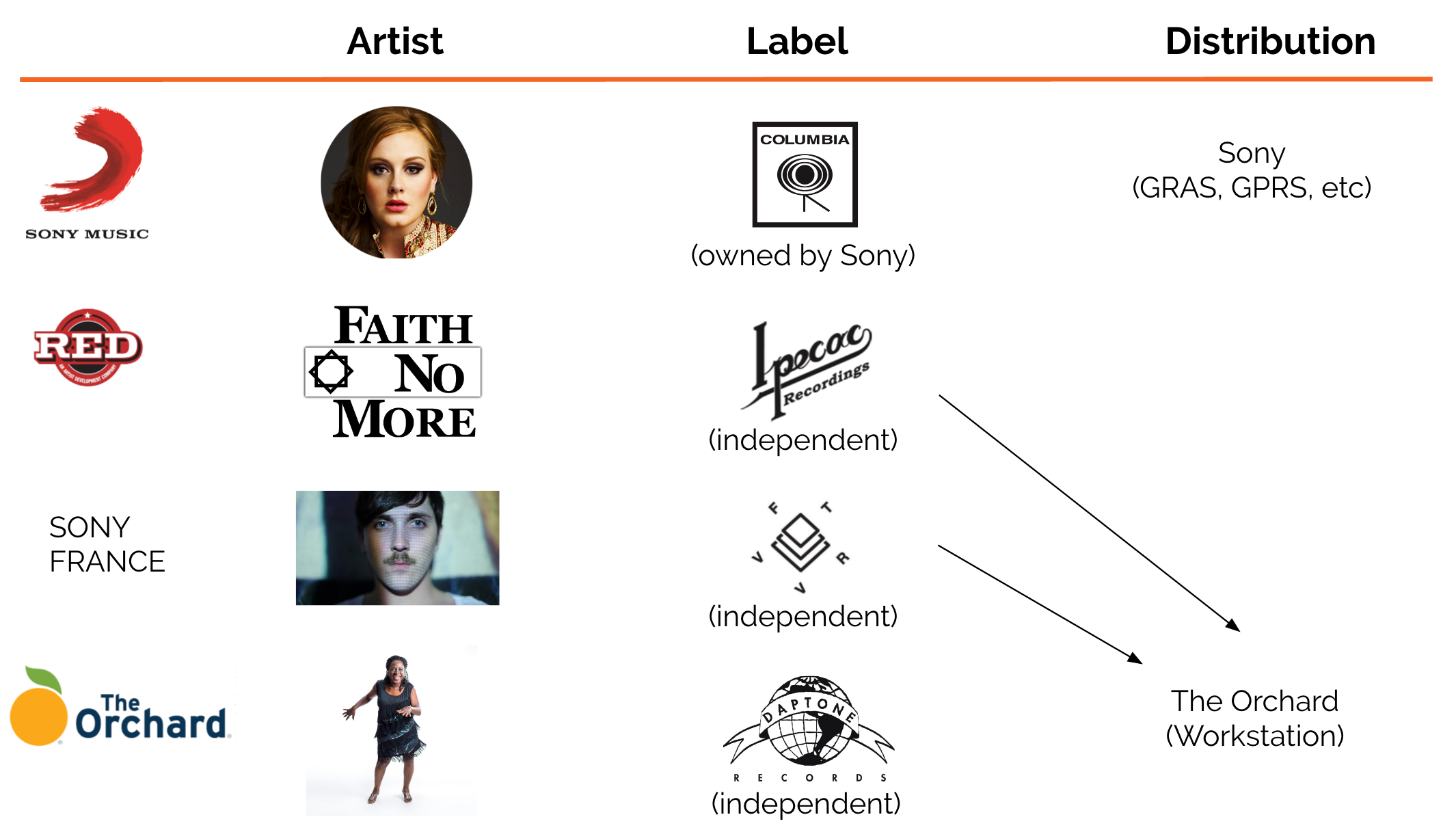

Sony Music has now indicated they want The Orchard Workstation to be the centerpiece of their global distribute label business, including:

- Sony International Affiliates

- RED Distribution

These businesses have different expectations and needs from our existing clients. If we can meet them, we can distribute very high value labels and artists.

There is now an opportunity to move upmarket in a dramatic way, if we can meet the needs of those labels and artists. In addition to Sony and RED, The Orchard would be well positioned to sign other high value clients.

Goal

To build a next generation full service distribution platform

WHAT WOULD WE NEED TO SUPPORT?

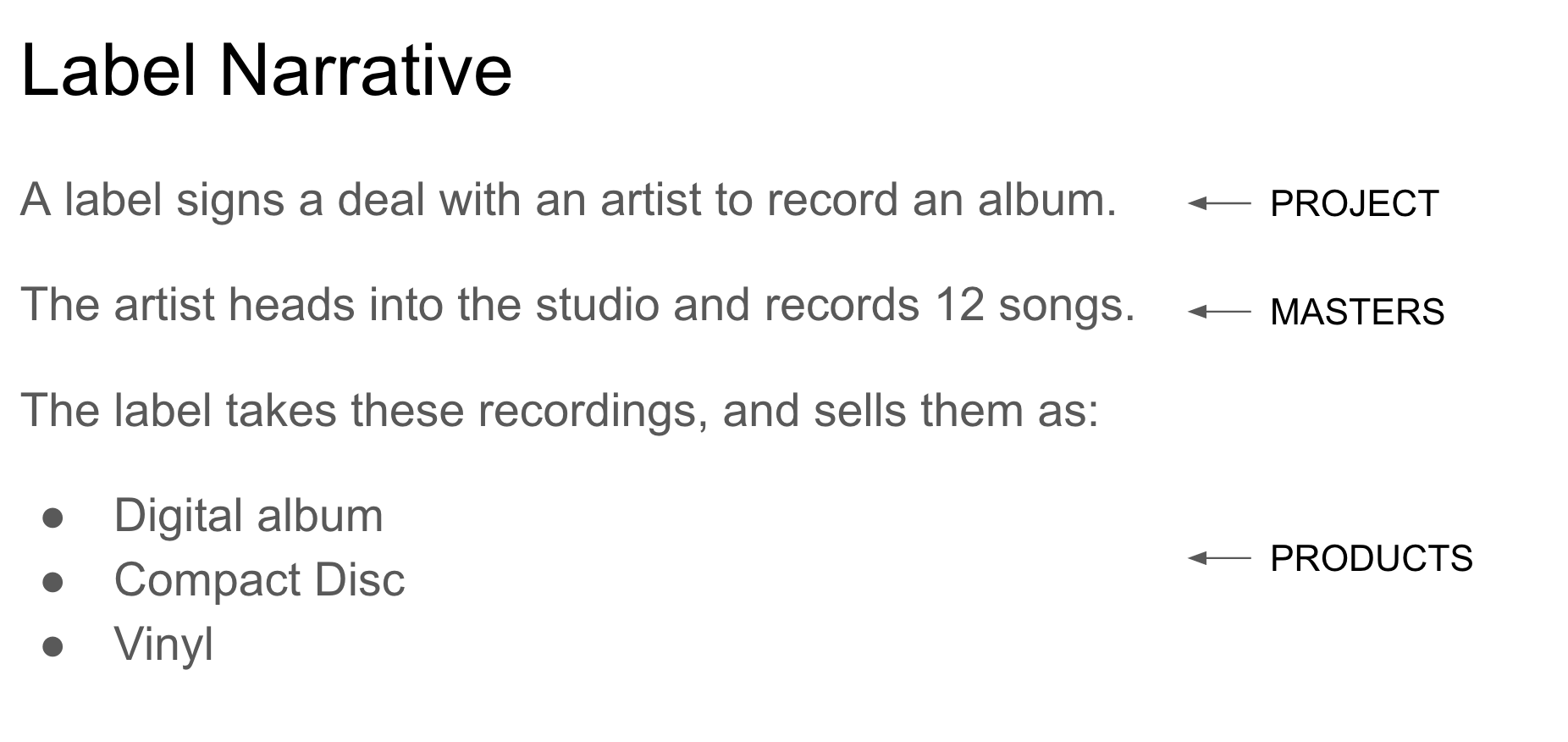

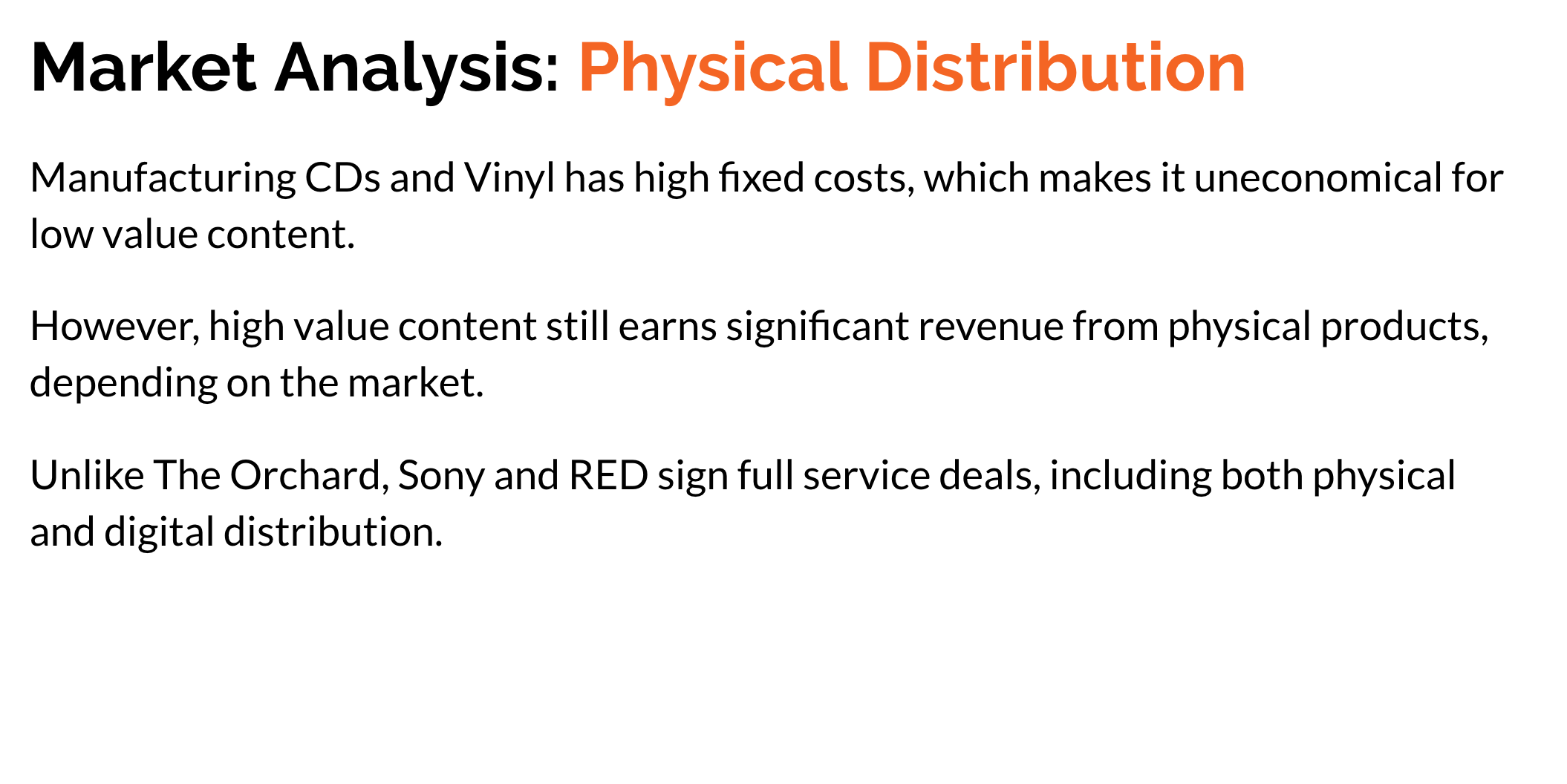

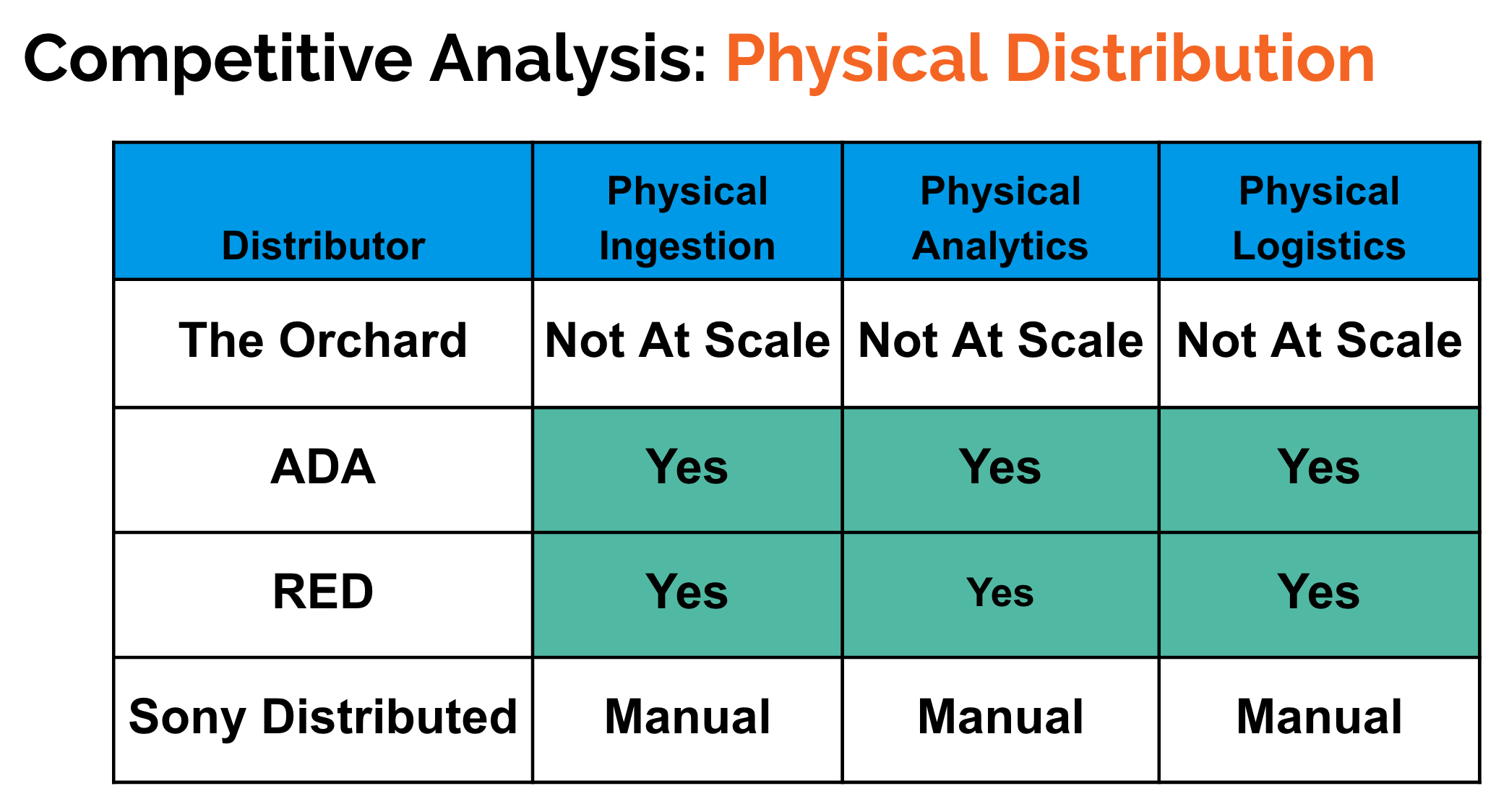

Physical Distribution

- Manufacturing CDs and Vinyl has high fixed costs, which makes it uneconomical for low value content.

- However, high value content still earns significant revenue from physical products, depending on the market.

- Unlike The Orchard, Sony and RED sign full service deals, including both physical and digital distribution.

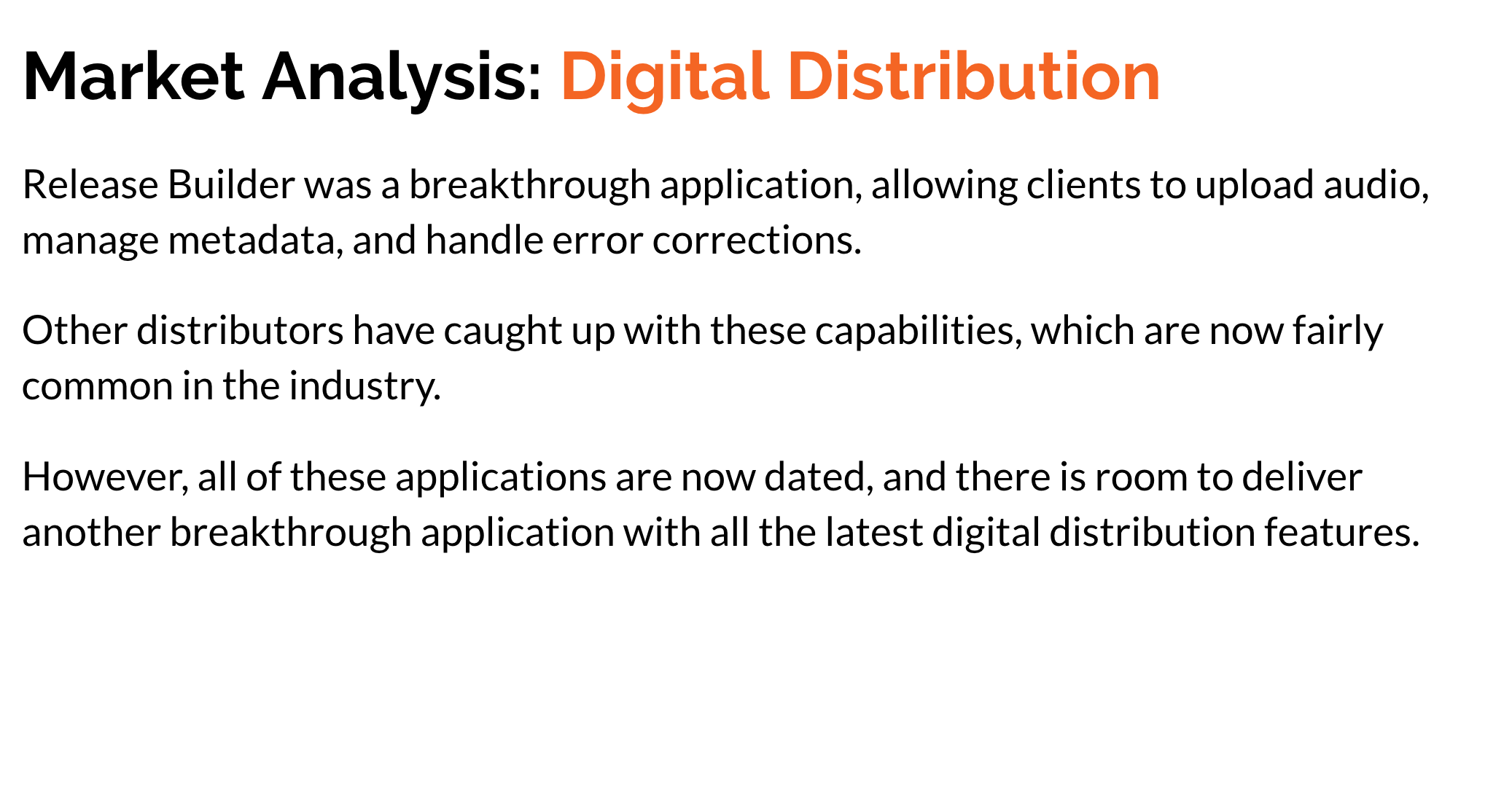

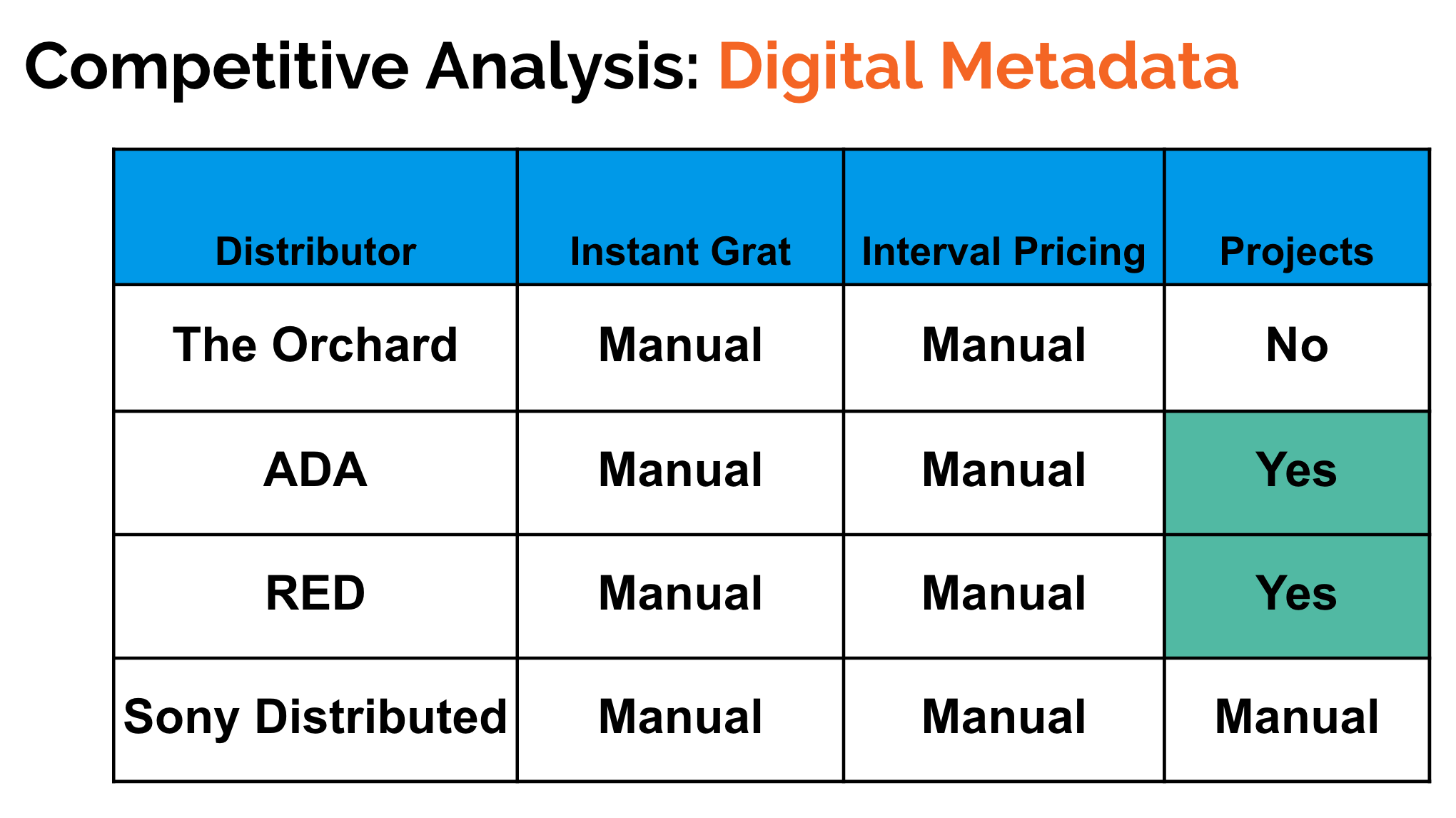

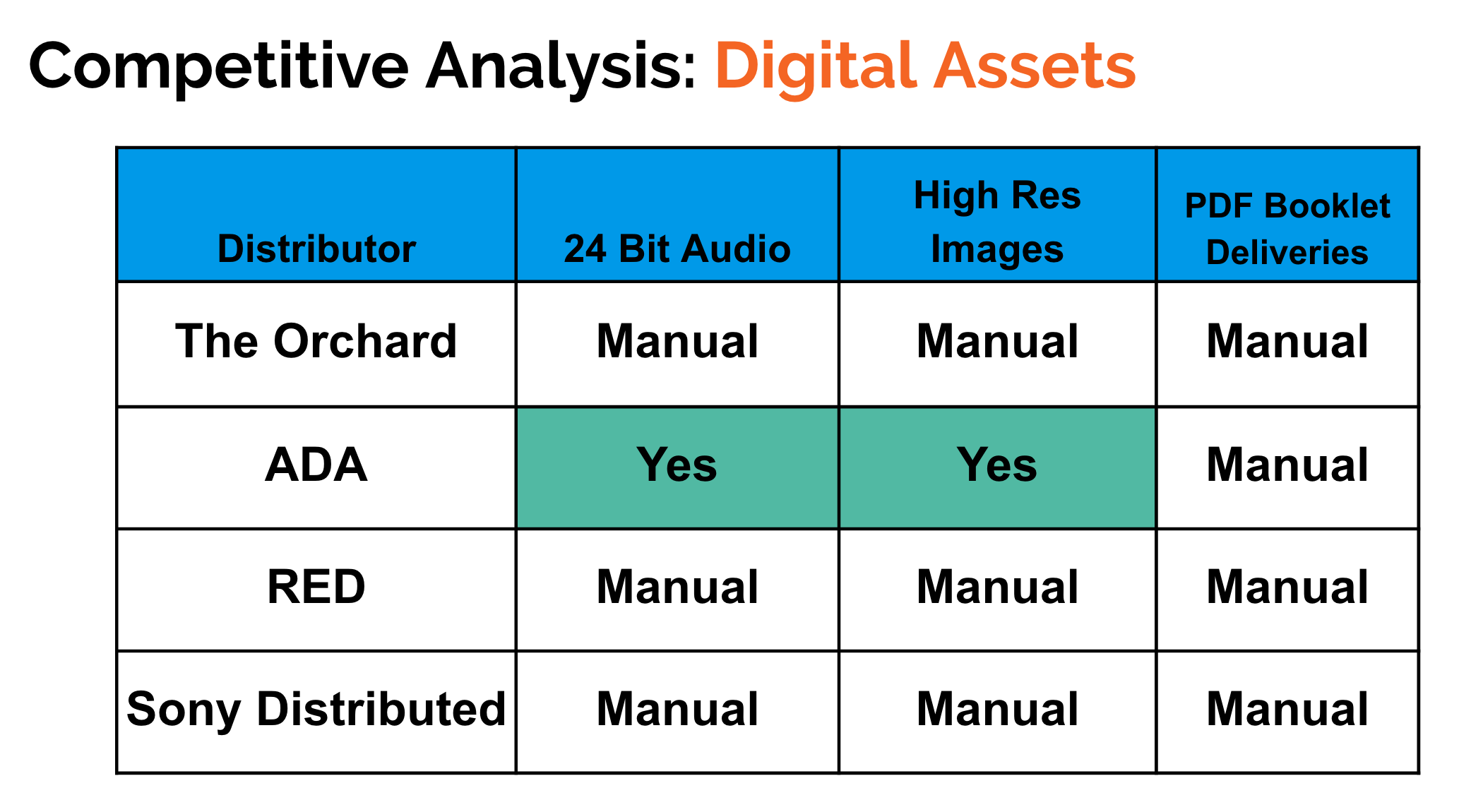

Digital Distribution

- With higher value content, there is even more need to take advantage of features such as:

- Instant grat tracks - configuring certain tracks to be available immediately upon pre-order

- Pricing intervals - configuring start and end dates to schedule price “windows” ahead of time

- 24 bit audio - for “Mastered for iTunes” or other HD retailers

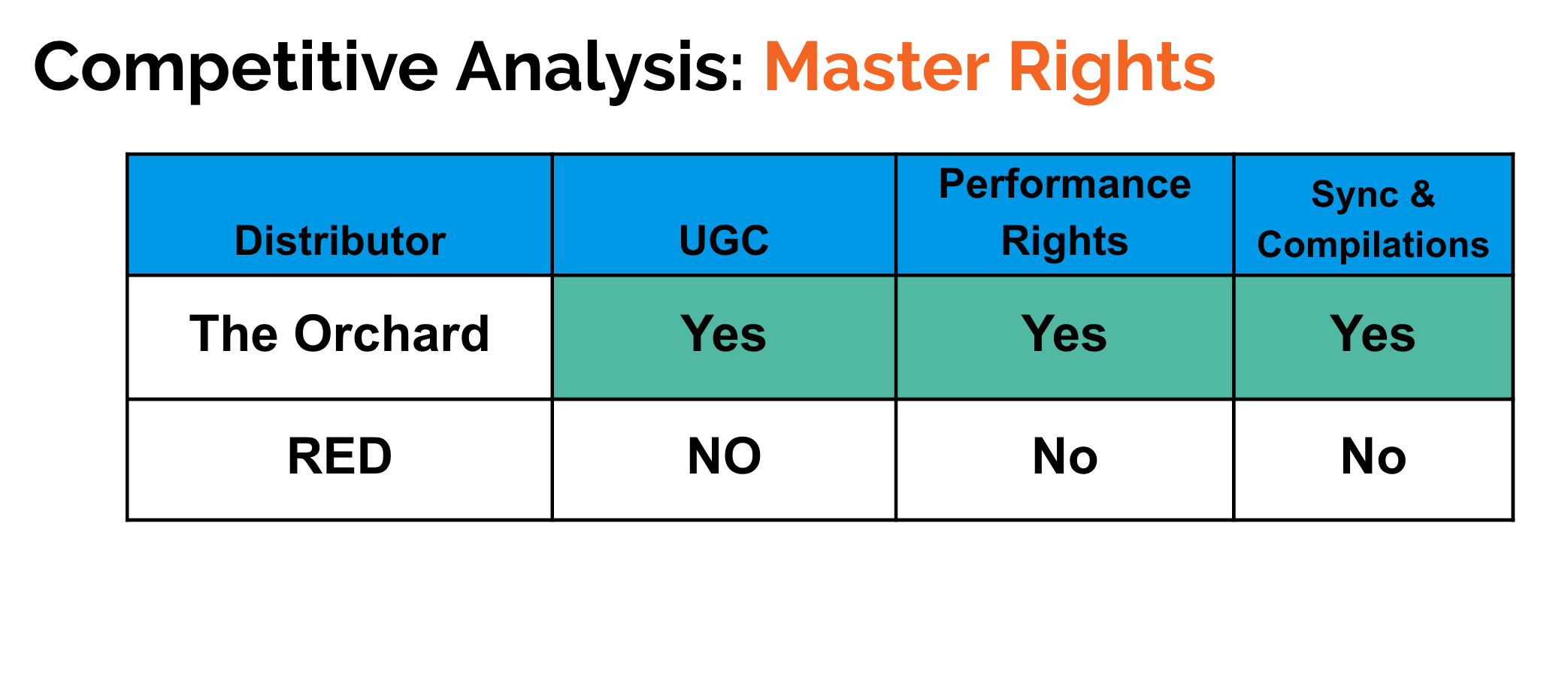

Master Rights

Master Rights exploitation includes monetizing:

- UGC (user generated content) at services like YouTube, SoundCloud, etc

- Radio play from performance rights societies

- Licensing opportunities (sync, compilations, etc)

The higher value the content is, the more these revenue streams come into play. These are significant revenue drivers for Sony’s owned catalog, and Sony is interested in bringing these offerings to its distributed label business. Labels need to either own or exclusively control their content to participate in these revenue streams.

HOW CLOSE ARE WE TODAY?

Physical Distribution

- The Orchard has a small scale physical distribution offering today.

- The process happens primarily outside OA / Workstation.

- Physical releases are not in our Releases table

- Marketing and manufacturing expenses come in as manual adjustments

- Physical revenue comes in as manual adjustments

- There is no unified place to see physical and digital revenue for an album

Digital Distribution

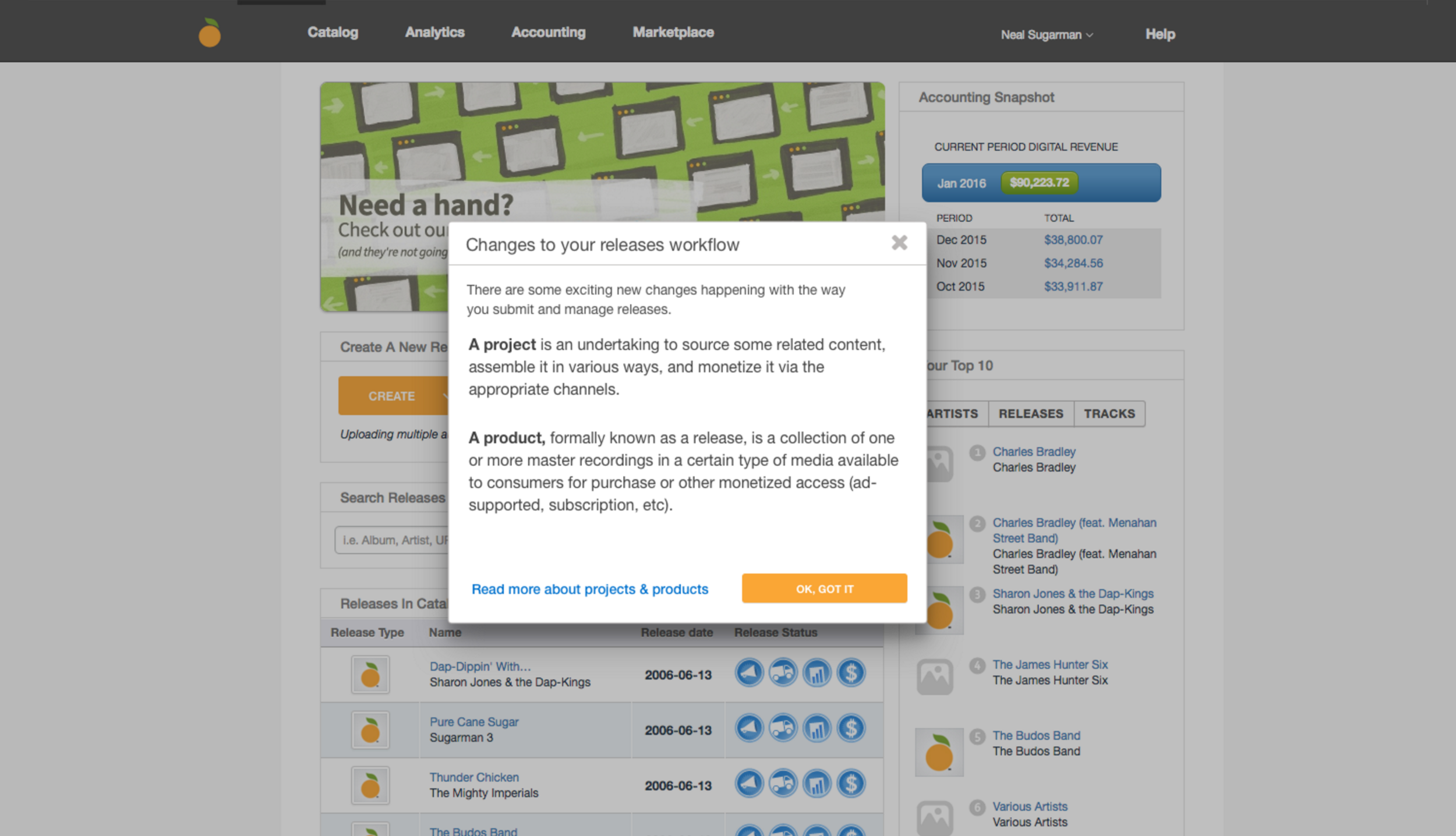

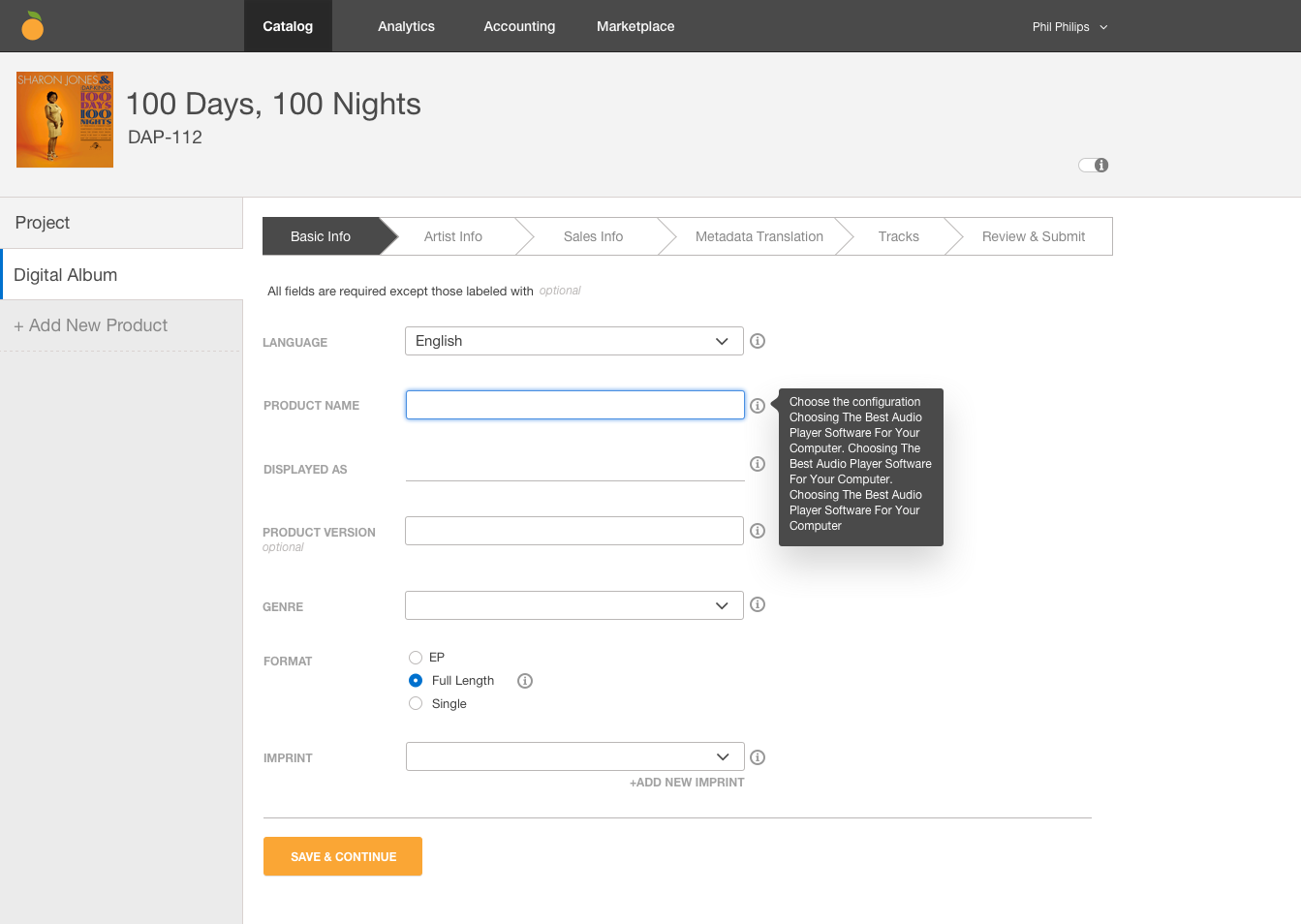

- Release Builder does not currently have the latest and greatest features, such as instant grat tracks or interval pricing

- It is difficult to add these features

- Aging codebase not up to current best practices

- Very little test coverage due to use of Flash

- “Label Catalog Number” aggregates different versions of an album, but it’s not explained clearly and causes confusion

- We need to modernize our approach to digital distribution

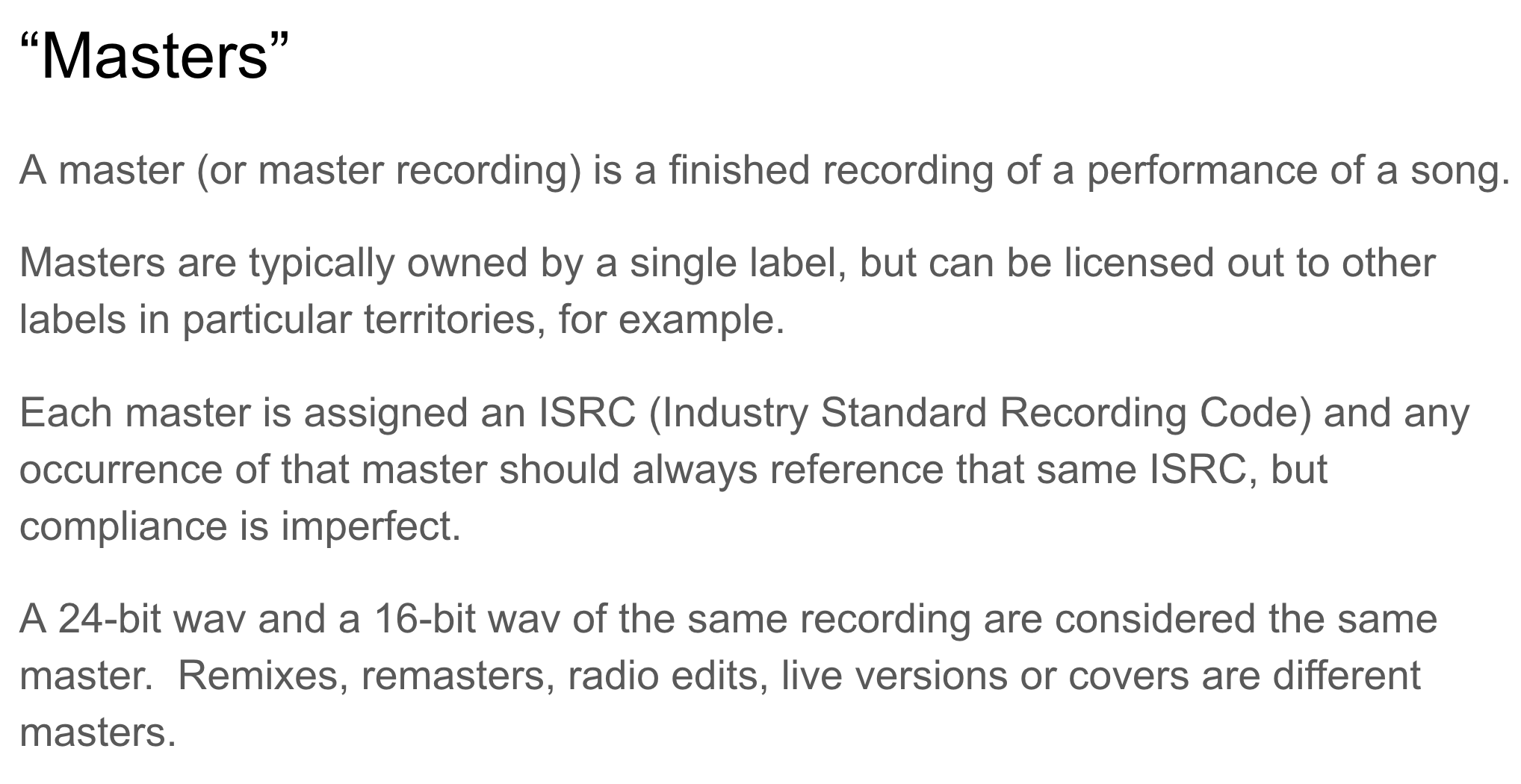

Master Rights

- We currently do not track in a systematic way who owns or controls which content in which territories, as opposed to merely have a non-exclusive distribution rights.

- This causes significant operational headaches such as sending the same master to YouTube or performance rights societies multiple times causing “duplicate ISRC” issues.

- We do not have a true place for clients to manage these rights, outside of spreadsheets.

CONCEPTUAL FRAMEWORK FOR CONTENT

DISTRIBUTION

To define the scope of the project in its entirety it was important that I lay out in detail for our stakeholders the current state of our offering. This then allowed stakeholders to better understand how much effort it would take to meet the specified goals.

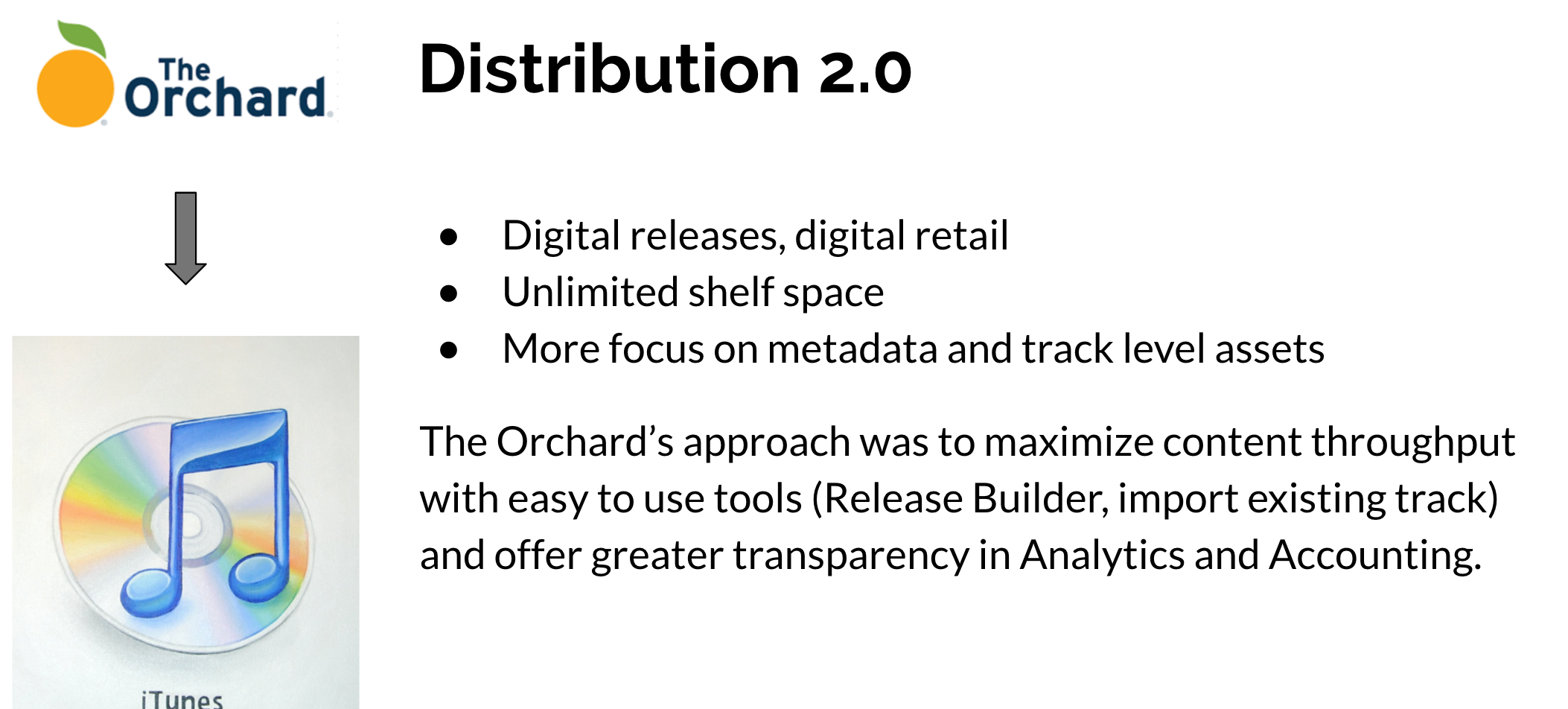

EVOLUTION OF DISTRIBUTION AT THE ORCHARD

COMPETITIVE ANALYSIS

PRODUCT SCREENSHOTS